You want to create payrolls from previous months and forward them to your tax consultant?

First check that all the setting in the employee profile are correct. Has the hourly wage and the correct payroll onset been filed in "Records"? Are all the requested absences confirmed or rejected?

You can now create a payroll once you have checked everything.

Manual payroll

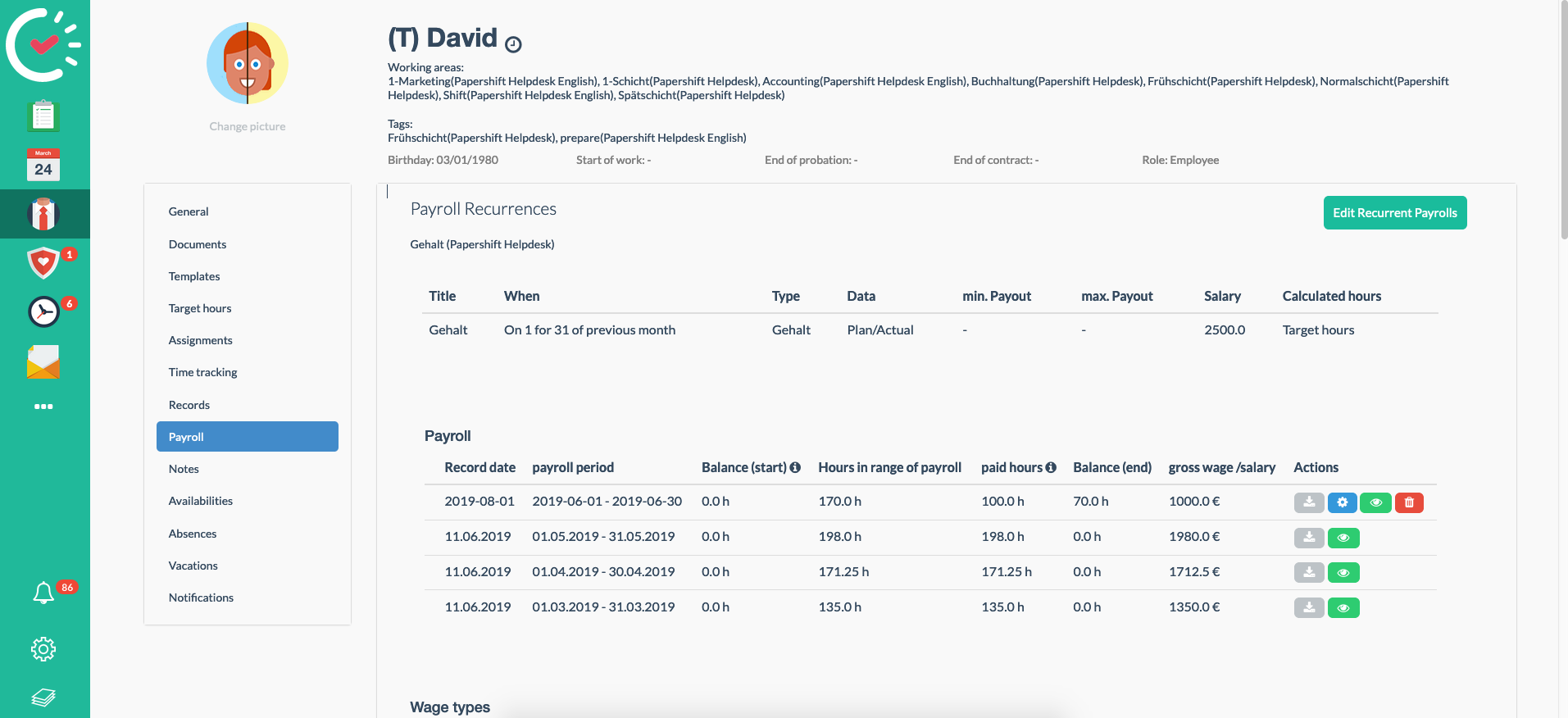

Go into the employee profile and click on the tab "Payroll". To do this, filter the period for which no payroll has yet been created and click on the green button with the € symbol on the day before your desired reporting date.

The system now adds up all the employee's times up until this date and multiplies them by the hourly wage on file.

You can then accept the given amounts or enter your own amounts for the payroll.

Now repeat this process for all the payroll time periods for which no payroll yet exists.

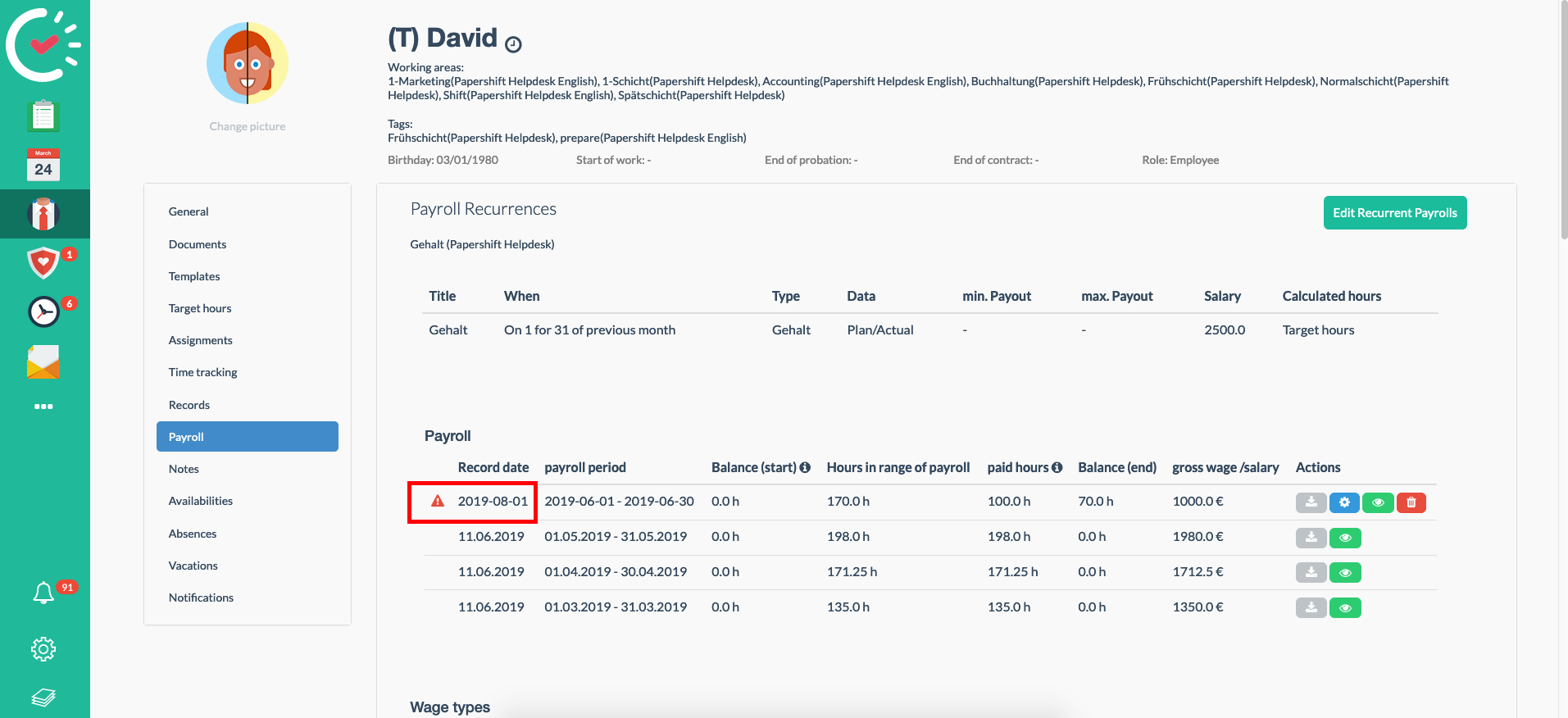

Subsequent changes to the balance

If, after creating a payroll, an absence or time tracking has changed in the payroll period, you will see an exclamation mark in a red triangle next to the payroll. This shows you that the payroll no longer correlates with the data on file in Papershift.

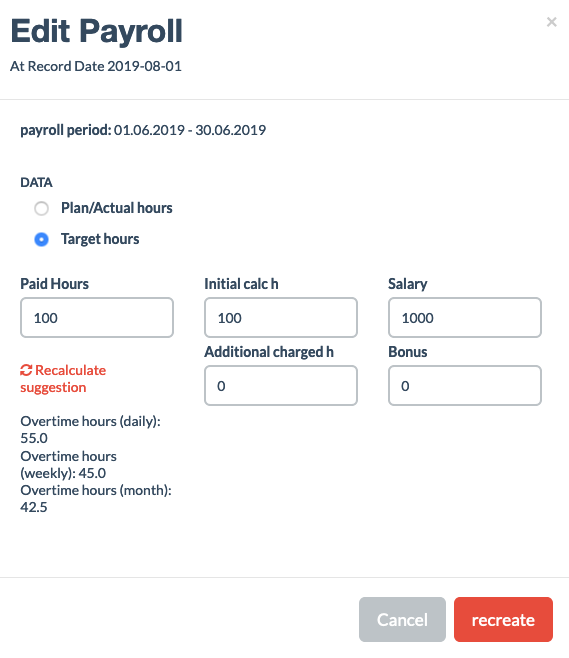

To update the payroll, click on the blue button with the gear icon and then click on "Recalculate proposal" in the newly opened window. You can then save the changes via the "Create new" button and export the payroll again.

If you have any questions about your individual application, you are welcome to contact us via chat, email, or by telephone at any time.